40 treasury bill coupon rate

Coupon Interest and Yield for eTBs - australiangovernmentbonds The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months. A guide to US Treasuries Treasuries are issued in six main structures. Usually, the longer the maturity, the higher the interest rate, or coupon . Treasury bills (T-bills): T-bills have the shortest maturities at four, eight, 13, 26, and 52 weeks. T-bills are typically issued at a discount to par (or face) value, with interest as well as principal paid at maturity.

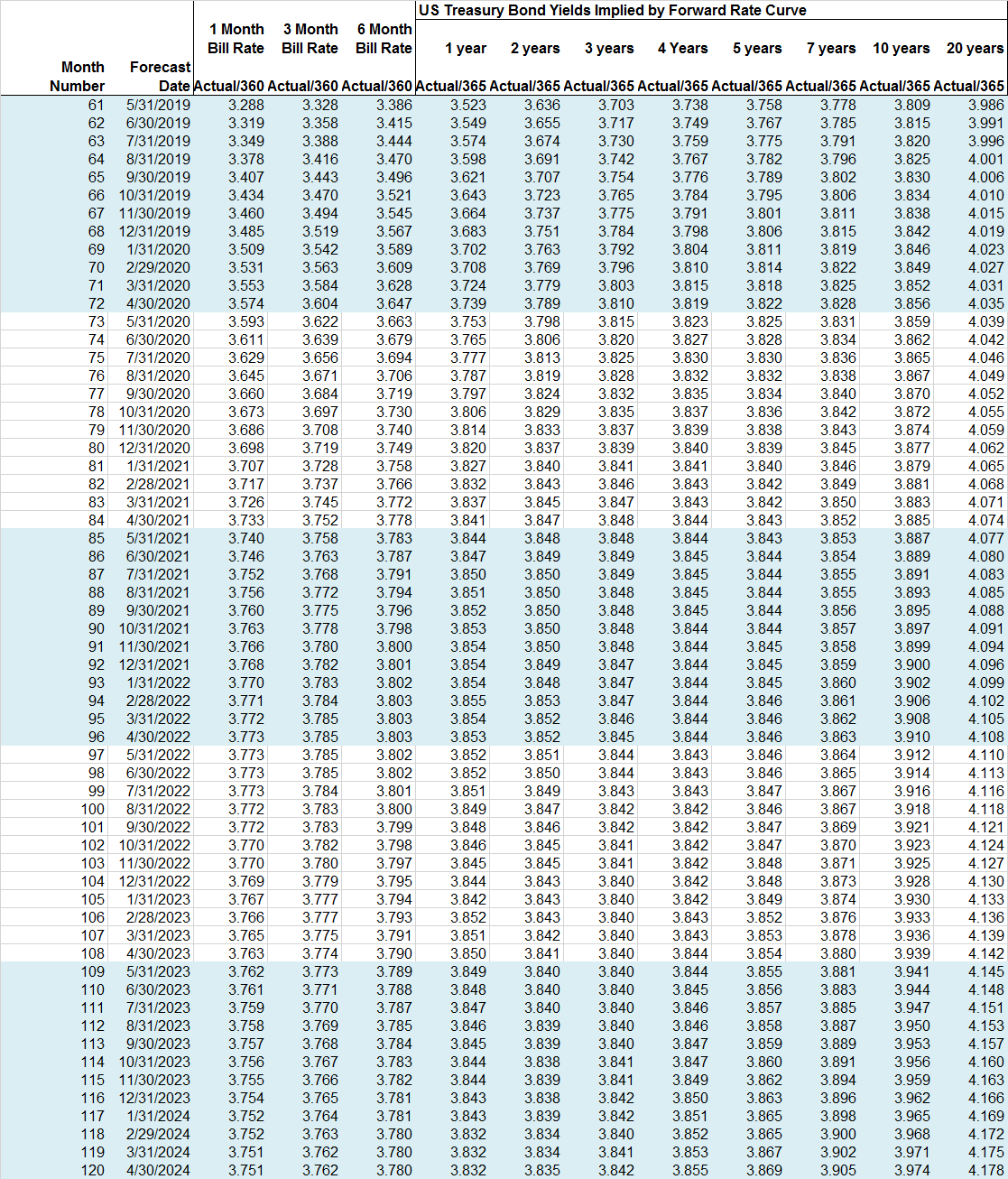

Treasury Coupon Issues | U.S. Department of the Treasury TNC Treasury Yield Curve Spot Rates, Monthly Average: 2008-2012 TNC Treasury Yield Curve Spot Rates, Monthly Average: 2013-2017 TNC Treasury Yield Curve Spot Rates, Monthly Average: 2018-Present. TNC Treasury Yield Curve Spot Rates, Quarterly Average: 2003-2007 TNC Treasury Yield Curve Spot Rates, Quarterly Average: 2008-2012

Treasury bill coupon rate

PDF Price, Yield and Rate Calculations for a Treasury Bill ... Calculate Coupon Equivalent Yield In order to calculate the Coupon Equivalent Yield on a Treasury Bill you must first solve for the intermediate variables in the equation. In this formula they are addressed as: a, b, and c. 364 0.25 (4) a = Calculate Coupon Equivalent Yield For bills of not more than one half-year to maturity Treasury Rates, Interest Rates, Yields - Barchart.com Treasury Rates. This table lists the major interest rates for US Treasury Bills and shows how these rates have moved over the last 1, 3, 6, and 12 months. Click on any Rate to view a detailed quote. Treasury bills, notes and bonds are sold by the U.S. Treasury Department. Treasury Bills (T-Bills) - What They Are & How to Buy for ... The Treasury auctions T-bills to investors, who purchase the security at a discount to the face value. For example, an investor may purchase a bill with a $1,000 face value and a six-month maturity at a price of $950. In six months, when the investment matures, the investor receives $1,000, producing $50 in profit.

Treasury bill coupon rate. Treasury Bills (T-Bills) - Meaning, Examples, Calculations For example, The US Federal Treasury Department issued 52week T-Bills at a discounted rate of $97 per bill at face value of $100. An investor purchases 10 T-Bills at a competitive bid price of $97 per bill and invests a total of $970. After 52 weeks, the T bills matured. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate remains fixed over the lifetime of the bond, while the yield-to-maturity is bound to change. When calculating the yield-to-maturity, you take into account the coupon rate and any increase or decrease in the price of the bond. ... Examples of zero-coupon bonds include U.S. Treasury bills and U.S. savings bonds. Insurance ... Interest Rate Statistics | U.S. Department of the Treasury Daily Treasury Bill Rates These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter market as obtained by the Federal Reserve Bank of New York at approximately 3:30 PM each business day. View the Daily Treasury Bill Rates Daily Treasury Long-Term Rates and Extrapolation Factors Understanding Coupon Rate and Yield to Maturity of Bonds ... The frequency of payment depends on the type of fixed income security. In the above example, a Retail Treasury Bill (RTB) pays coupons quarterly. To translate this to quarterly payment, first, multiply the coupon rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4.

Treasury Bills vs Bonds | Top 5 Differences (with ... Coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more: T-bills do not pay any coupon. Investing in Treasury Bills: The Safest Investment in 2022 A Treasury bill is any bond issued with a maturity of one year or less. Treasury notes have maturities from two to 10 years. And Treasury bonds mature 20 years or later. (For simplicity, this article refers to all three as "Treasury bills" or "T-bills" or simply "Treasuries.") Treasury bills are seen as the safest bonds in the world ... How Are Treasury Bill Interest Rates Determined? The interest rate comes from the spread between the discounted purchase price and the face value redemption price. 3 For example, suppose an investor purchases a 52-week T-bill with a face value... What are coupons in treasury bills/bonds? - Quora The "coupon" on a T-note or T-bond is the contractual rate as a percentage of par that will be paid to the holder one-half each time twice a year. A 6% treasury note due November 15, 20xx will pay the holder $30 per $1,000 face value of the note on May and November 15th of each year until the due date. 49 views Answer requested by Hussain Sajwani

Daily Treasury Bill Rates Data - CKAN The Bank Discount rate is the rate at which a Bill is quoted in the secondary market and is based on the par value, amount of the discount and a 360-day year. The Coupon Equivalent, also called the Bond Equivalent, or the Investment Yield, is the bill's yield based on the purchase price, discount, and a 365- or 366-day year. Treasury I-Bonds are Paying 7.12%! — Sapient Investments The inflation adjustment for I-bonds is made twice yearly, on May 1 and November 1. The inflation rate for the preceding six months (lagged by a month) is annualized and added to the fixed rate to get the new combined rate. The graph above compares the nominal I-bond yield with the 6-month Treasury bill yield. Both are reset every six months. Covid-19 Economic Relief | U.S. Department of the Treasury Latest Programs and Updates American Rescue Plan Six Month In total, the Treasury Department is responsible for managing over $1 trillion in American Rescue Plan programs and tax credits. Read about the impact of the first six months of the American Rescue Plan programs in the impact report. Economic Impact Payments The Treasury Department, the Office of … 91 Day T Bill Treasury Rate - Bankrate 91-day T-bill auction avg disc rate. 0.90. 0.86. 0.02. What it means: The U.S. government issues short-term debt at a discount at a competitive auction, usually on a weekly basis. At a discount ...

Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value)...

Price, Yield and Rate Calculations for a Treasury Bill Calculate the ... Calculate Coupon Equivalent Yield In order to calculate the Coupon Equivalent Yield on a Treasury Bill you must first solve for the intermediate variables in the equation. In this formula they are addressed as: a, b, and c. 364 0.25 (4) a = Calculate Coupon Equivalent Yield For bills of not more than one half-year to maturity

US Treasury Bonds - Fidelity Investments The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

Individual - Treasury Bills In Depth Treasury bills, or T-bills, are typically issued at a discount from the par amount (also called face value). For example, if you buy a $1,000 bill at a price per $100 of $99.986111, then you would pay $999.86 ($1,000 x .99986111 = $999.86111).* When the bill matures, you would be paid its face value, $1,000.

What Is a Treasury Note? How Treasury Notes Work for Beginners A Treasury note is a type of U.S. government debt security with a set interest rate and a maturity period ranging from one to ten years. Interest rates are determined at the federal level, just like a Treasury bond or a Treasury bill. Treasury notes are highly common investments because they are available on the secondary market.

Post a Comment for "40 treasury bill coupon rate"