42 zero coupon bond investopedia

What are Zero coupon bonds? - INSIGHTSIAS What are these special type of zero coupon bonds? These are "non-interest bearing, non-transferable special GOI securities". They have a maturity of 10-15 years and issued specifically to Punjab & Sind Bank. These recapitalisation bonds are special types of bonds issued by the Central government specifically to a particular institution. Zero Coupon Treasury Bond - bizimkonak.com Zero-Coupon Bonds and Taxes - Investopedia. CODES (9 days ago) A zero-coupon bond does not pay coupons or interest payments like a typical bond does; instead, a zero-coupon holder receives the face value of the bond at maturity. Treasury Bonds vs . Visit URL. Category: coupon codes Show All Coupons .

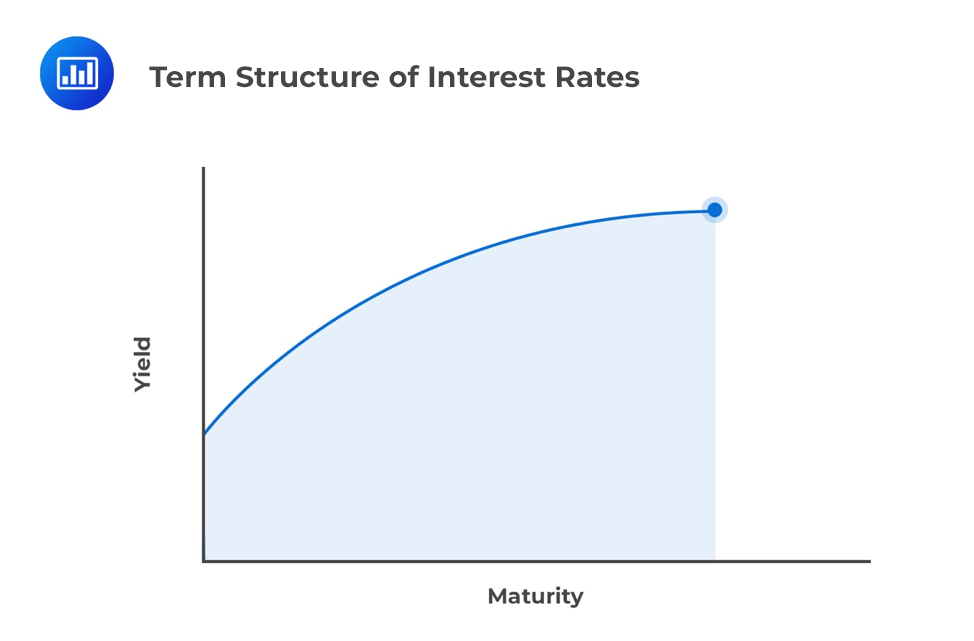

What Is a Zero Coupon Yield Curve? - Smart Capital Mind The zero coupon rate is the return, or yield, on a bond corresponding to a single cash payment at a particular time in the future. This would represent the return on an investment in a zero coupon bond with a particular time to maturity. The zero coupon yield curve shows in graphical form the rates of return on zero coupon bonds with different ...

Zero coupon bond investopedia

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Zero-coupon bonds essentially lock the investor into a guaranteed reinvestment rate. This arrangement can be most advantageous when interest rates are high and when placed in tax-advantaged... Zero-Coupon Bonds : r/Superstonk - reddit Zero-Coupon bonds pay no interest but trade at a deep discount and pay a profit when the bond matures. The difference between the purchase price and the value of the bond is the investor's return. For example, if a zero-interest bond has a face value of 1000 in 5 years, they may sell for 800 right now. In five years, you would be paid 1000. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon U.S. Treasury bonds can move up significantly when the Fed cuts rates aggressively. 1 These gains can more than offset stock related losses, so Treasury zeros are often an...

Zero coupon bond investopedia. How to Calculate Yield to Maturity of a Zero-Coupon Bond Investing/Trading Investing Essentials Fundamental Analysis Portfolio Management Trading Essentials Zero Coupon Corporate Bonds - bizimkonak.com Zero coupon bonds, also known as zeros, are distinct in that they do not make annual interest payments. The bonds are sold at a deep discount, and the principal plus accrued interest is … Visit URL Category: coupon codes Show All Coupons How to Calculate Yield to Maturity of a Zero-Coupon … CODES Bond s nulovým kupónom. (Zero-Coupon Bond) - Investopedia Bond s nulovým kupónom. (Zero-Coupon Bond) - Investopedia Bond s nulovým kupónom. (Zero-Coupon Bond) Čo je to dlhopis s nulovým kupónom. Dlhopis s nulovým kupónom je dlhový cenný papier, ktorý neplatí úroky, ale namiesto toho obchoduje s hlbokou zľavou, ktorá vytvára zisk pri splatnosti, keď je dlhopis splatený za celú nominálnu hodnotu.1 zero coupon - Are pure PIK bonds' payoffs known from the start ... - Investopedia. Therefore, for these bonds to have a reason to exist, I would expect Y to not be known from the start. Is that the case, and if it is : what actually happens when a "coupon" is paid ? If additional bonds issued by the PIK bond issuer are used to pay, does the bond yield depend on the current yield investors ask of this company ...

Zero-Coupon Bonds and Taxes - Investopedia A zero-coupon bond will usually have higher returns than a regular bond with the same maturity because of the shape of the yield curve. Zero-coupon bonds are more volatile than coupon... What is zero coupon bond in India? - Quora A zero-coupon bond (also discount bond or deep discount bond) is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments, or have so-called "coupons", hence the term zero-coupon bond. All About Zero Coupon Bonds - finance.yahoo.com Zero-coupon bonds are bonds that do not make any interest payments (which investment professionals often refer to as the "coupon") until maturity. For investors, this means that if you make an... Zero coupon bonds - Chrome IAS A zero-coupon bond is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value. A zero-coupon bond is also known as an accrual bond.

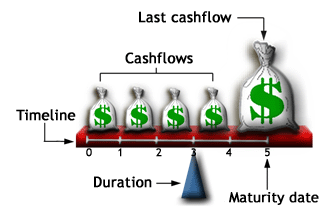

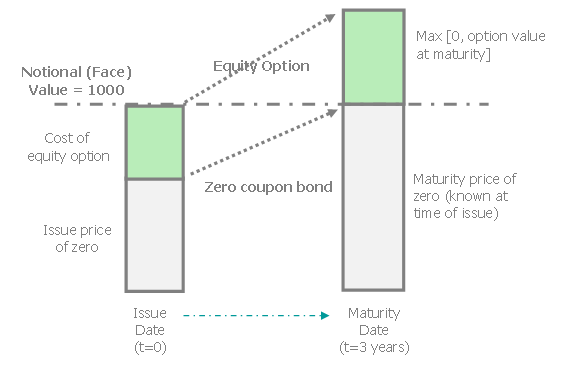

The Dummies Guide To Zero Coupon Bonds So, Market Value = $9478.67. This is what the price of this bond is today, at the specified discount rate. So what's my profit? Typically, you would know the market value and the future value (it's a zero coupon bond, there is only a single cash flow at maturity), so you can quickly calculate the internal rate of return or more commonly called as the yield-to-maturity (YTM). Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. Zero Coupon Bonds - Arbor Finance A zero-coupon bond (ZCB) does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value. The majority of this content was pulled from Investopedia and modified to better serve Arbor users. We thank Investopedia for providing these educational materials. Previous. FAQ. Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. [1] Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond. When the bond reaches maturity, its investor receives its par (or face) value.

What Is a Zero-Coupon Bond? - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is...

Zero-Coupon Swap Definition - Investopedia A zero-coupon swap is a derivative contract entered into by two parties. One party makes floating payments which changes according to the future publication of the interest rate index (e.g....

Investopedia Video: Zero-Coupon Bond - YouTube A debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full face value. For more Investopedia videos,...

How are zero-coupon bonds issued? - Quantitative Finance Stack Exchange 1. There is only one cashflow for the zero-coupon bond. At maturity, it pays the par value. They are always issued below par, as the buyer is paying the NPV for the bond that matures in the future. Here is a brief reference at Investopedia. A zero-coupon bond, also known as an "accrual bond," is a debt security that doesn't pay interest (a ...

Zero-coupon bond - Bogleheads Zero-coupon bonds or "zeros" result from the separation of coupons from the body of a security. Consequently, from a single coupon-paying bond, two bonds result: one which pays the coupons but returns no principal at maturity (an annuity), and one which pays no coupons but returns the par value at maturity (a zero-coupon bond).

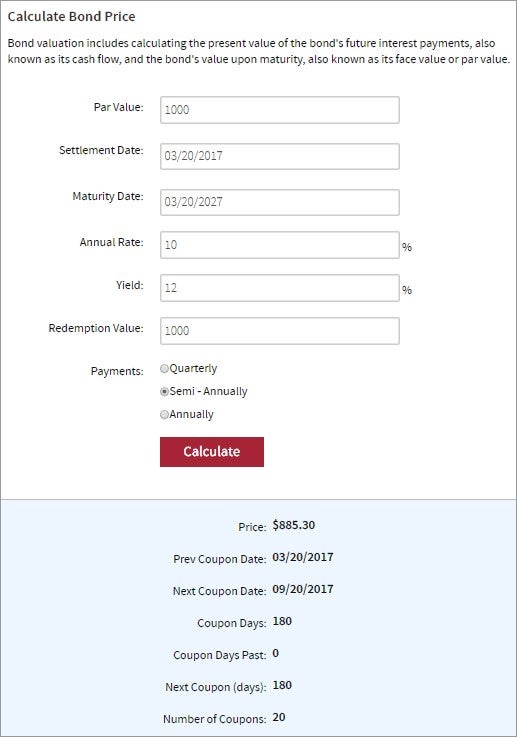

How to Calculate the Price of a Zero Coupon Bond Zero-Coupon Bond Price Example For example, say you want to earn a 6 percent rate of return per year on a bond with a face value of $2,000 that will mature in two years. First, divide 6 percent by 100 to get 0.06. Second, add 1 to 0.06 to get 1.06. Third, raise 1.06 to the second power to get 1.1236.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon U.S. Treasury bonds can move up significantly when the Fed cuts rates aggressively. 1 These gains can more than offset stock related losses, so Treasury zeros are often an...

Zero-Coupon Bonds : r/Superstonk - reddit Zero-Coupon bonds pay no interest but trade at a deep discount and pay a profit when the bond matures. The difference between the purchase price and the value of the bond is the investor's return. For example, if a zero-interest bond has a face value of 1000 in 5 years, they may sell for 800 right now. In five years, you would be paid 1000.

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Zero-coupon bonds essentially lock the investor into a guaranteed reinvestment rate. This arrangement can be most advantageous when interest rates are high and when placed in tax-advantaged...

/Compoundinterest-f0b145415f244b40bb93c82154e8343d.png)

/investopedia-social-share-default-ab113c8afd9a439dbc4c68b1926292f4.png)

:max_bytes(150000):strip_icc()/bond-5bfc37fec9e77c00514745d5.jpg)

/Cash-5b52a22a46e0fb003703909a.jpg)

/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

/GettyImages-182832748-af3f3d3824034fdaa66ac937fc2d7a40.jpg)

:max_bytes(150000):strip_icc()/bond.asp_final-76c865e23abe4f6c9e7c41a38cfe6e39.png)

/GettyImages-1127245349_2000-43e5aeb799b046208e88999c880bae2e.png)

:max_bytes(150000):strip_icc()/TermDefinitions_Timevalueofmoney_finalv1-2204ce86bd1c4d69a60b9a32fdfe3303.png)

/GettyImages-597139701-d3b44a08d65844a89c458a6ed9950100.jpg)

:max_bytes(150000):strip_icc()/personal-finance-lrg-3-5bfc2b1f46e0fb0051bdccb6.jpg)

/virtual_goods-5bfc2b8a46e0fb00517bdfe5.jpg)

Post a Comment for "42 zero coupon bond investopedia"